题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

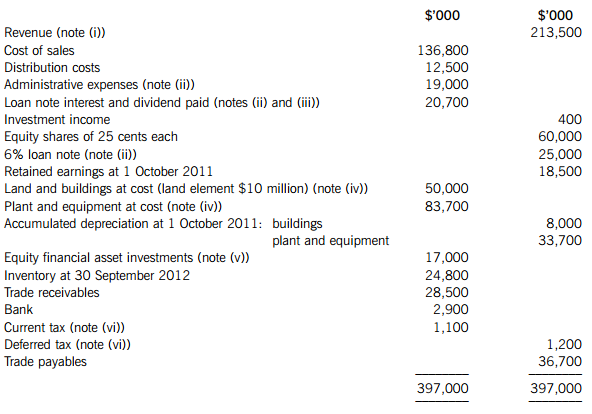

On 1 October 2010, Paladin secured a majority equity shareholding in Saracen on the follow

an immediate payment of $4 per share on 1 October 2010; and

a further amount deferred until 1 October 2011 of $5·4 million.

The immediate payment has been recorded in Paladin’s financial statements, but the deferred payment has not been recorded. Paladin’s cost of capital is 8% per annum.

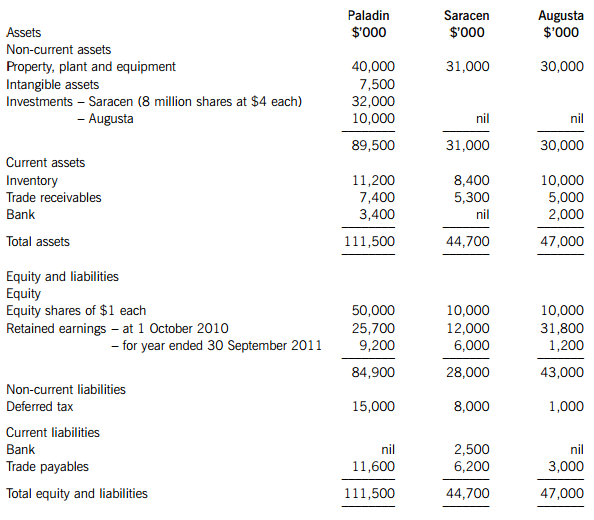

On 1 February 2011, Paladin also acquired 25% of the equity shares of Augusta paying $10 million in cash. The summarised statements of financial position of the three companies at 30 September 2011 are:

The following information is relevant:

(i) Paladin’s policy is to value the non-controlling interest at fair value at the date of acquisition. For this purpose the directors of Paladin considered a share price for Saracen of $3·50 per share to be appropriate.

(ii) At the date of acquisition, the fair values of Saracen’s property, plant and equipment was equal to its carrying amount with the exception of Saracen’s plant which had a fair value of $4 million above its carrying amount. At that date the plant had a remaining life of four years. Saracen uses straight-line depreciation for plant assuming a nil residual value. Also at the date of acquisition, Paladin valued Saracen’s customer relationships as a customer base intangible asset at fair value of $3 million. Saracen has not accounted for this asset. Trading relationships with Saracen’s customers last on average for six years.

(iii) At 30 September 2011, Saracen’s inventory included goods bought from Paladin (at cost to Saracen) of $2·6 million. Paladin had marked up these goods by 30% on cost. Paladin’s agreed current account balance owed by Saracen at 30 September 2011 was $1·3 million.

(iv) Impairment tests were carried out on 30 September 2011 which concluded that consolidated goodwill was not impaired, but, due to disappointing earnings, the value of the investment in Augusta was impaired by $2·5 million.

(v) Assume all profits accrue evenly through the year.

Required:

Prepare the consolidated statement of financial position for Paladin as at 30 September 2011.

答案

答案